pay ohio unemployment taxes online

The Gateway populates previously reported employees and wage data. Payments by Electronic Check or CreditDebit Card.

Offer helpful instructions and related details about Pay Ohio Unemployment Tax - make it easier for users to find business information than ever.

. If the employer is unsure of their filing frequency they may contact the Ohio Department of Taxation at 1-888-405-4039 for verification. For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text. Mailing address telephone number andor email address with the Department.

Once the missing Quarterly Tax Return is processed you will be assessed penalty and interest. You can also view outstanding balances if any and update certain contact information ie. 41 Our company received a letter stating that we may be overpaid on our account.

By calling 877 644-6562 or TTY 614 387-8408. Should you have any questions please call the contribution section at 614-466-2319. If you need to file an appeal please visit PUAAjfsohiogov.

Learn about Ohio unemployment benefits from the Ohio Department of Job and Family Services. Select the Payments tab from the My Home page. Payments by Electronic Check or CreditDebit Card.

For step-by-step instructions on how to apply for benefits online see the Workers Self-Service User Guide. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19. Reporting their unemployment tax liability as soon as there are one or more employees in covered employmentThis may be done at thesourcejfsohiogov or by completing the JFS 20100 Report to Determine Liability and mailing it to PO.

Top Ten Home Alarm Systems Top Rated Home Security Companies Top 10 Best Security Systems. Unemployment Tax Payment Process. Box 182404 Columbus Ohio 43218-2404If you report your liability at thesourcejfsohiogov you will receive a determination immediately.

Paper Form Exception Filing Information In Ohio employers are required to submit their Quarterly Tax Return. For more information see page 5 of the Workers Guide to Unemployment. Also you have the ability to view payments made within the past 61 months.

The employer must file their school district withholding returns according to their filing frequency. However we are accepting taxpayers by appointment only. Logon to Unemployment Tax Services.

Visit the Ohio Business Gateway and click Create an Account. The Ohio Business Gateway is another option available to submit current quarter unemployment reports and payments. Up to 25 cash back That amount known as the taxable wage base has been stable at 9000 in Ohio since the year 2000.

Expand All Sections Web Content Viewer. The state UI tax rate for new employers also known as the standard beginning tax rate can change from one year to the next. Report it by calling toll-free.

Your account will be locked after 3 unsuccessful attempts. One Government Center Suite 2070. Our office is currently closed to the public for walk in traffic.

The online registration process can take 1-2 days. As a result PUA claims are no longer being accepted. Below are the helpful webpages that can assist you with any additional questions you may have.

Or you can file for unemployment benefits by phone Monday through Friday except holidays from 8 am. Several options are available for paying your Ohio andor school district income tax. Please use the following steps in paying your unemployment taxes.

In recent years however it has been stable at 27. Allows you to viewprint transcripts of previously filed returns up to 10 years and Ohio 1099-G1099-INT forms up to 5 years. Bank Account Online ACH Debit or Credit Card American Express Discover MasterCard or Visa from the Make Payment page.

Several options are available for paying your Ohio andor school district income tax. Apply for Unemployment Now Employee 1099 Employee Employer. If you have an existing PUA account you still can access it by entering your Social Security number and password below.

Payments by Electronic Check or CreditDebit Card. Offer helpful instructions and related details about Pay Ohio Unemployment Taxes Online - make it easier for users to find business information than ever. For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text.

If you are having problems logging in select the. The Ohio Department of Job and Family Services Mike DeWine Governor Matt Damschroder ODJFS Director. If you have questions contact the Office of Unemployment Compensation Division of Tax and Employer Service at 614 466-2319.

However its always possible the amount could change. When you enter wage information the Gateway automatically calculates the taxable wages and contributions taxes due for you and provides payment options. You may apply for a waiver of these assessments.

Ad Pay Your Taxes Bill Online with doxo. File Unemployment Taxes Online. Ohio ePayment allows you to make your Ohio individual income and school district income payments electronically.

Register with the Ohio Department of Taxation. Select a payment option. If you cannot locate this document or account number please call the Ohio Department of Taxation at 888 405-4039 to request it.

What are the consequences of failing to file or pay unemployment insurance taxes.

Odjfs Works To Recover Over 500 Million In Fraud Claims S B 302 Calling For Safeguards Wrgt

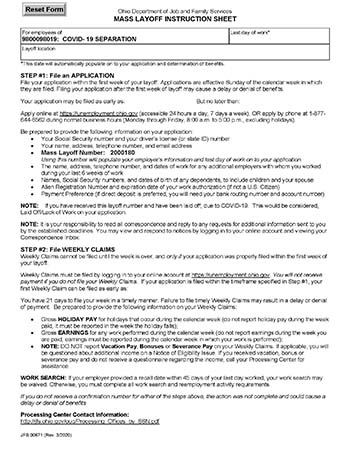

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Ohio Waivers Now Available For Pandemic Unemployment Overpayments Cleveland Com

Ohio S New Unemployment Insurance Tax System Goes Live Dec 6 Business Journal Daily The Youngstown Publishing Company

Labor Employment Alert Guidance On Ohio Unemployment Compensation Brouse Mcdowell Ohio Law Firm

Did You Receive Any Of These Documents Ohio Unemployment Benefits Help

Unemployment Insurance Ohio Gov Official Website Of The State Of Ohio

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

Ohio Launches Online Application For Pandemic Unemployment Assistance Program

Did You Receive Any Of These Documents Ohio Unemployment Benefits Help

Ohio Department Of Job And Family Services Posts Jobs With No Medical Benefits Cleveland Com

Some People Not Receiving Unemployment 1099 G Tax Forms

How To Apply For Unemployment Benefits Online In Ohio Youtube